Project Objective

The objective of the project is to study the efficiency of Bullion Futures for Hedging risks in Currency, Energy Markets and efficiency of Price Discovery process for Agricultural Commodities at NCDEX.

The aim of this study was to develop quantitative models to excite traders to come to NCDEX and trade. If its possible to show them that there are trading techniques which can be applied at NCDEX, it would be instrumental in increasing the volumes traded at the exchange and make more profits for the exchange.

The entire project is divided into two parts-

Primary

1. Study the use of Gold Futures in hedging the movements of Energy Markets (Crude Oil) price fluctuation.

2. Factors that affect Gold price fluctuation in International Markets.

3. Comparison of returns from investment in Gold futures and expected returns from other equity and fixed investment instruments available (Government Bonds, Fixed Deposits, General Securities, Risk Free bank deposits).

4. Comments on ‘Gold Bubble’ based on empirical data.

Secondary

To study the price discovery process of Guar Gum and Potato Commodities at NCDEX

Methodology

Primary

1. Find Correlation between Gold Futures prices and Brent Crude Oil prices

2. Analysis of Trading patterns for Gold Futures and Brent Crude Oil in spot market.

3. Hedging Strategies used by hedgers

4. Development of optimal Hedging Strategy for Gold Futures and Brent Crude Oil spot.

5. Understanding various Trading techniques in Gold Futures

a. Various types of Spread Trading

6. Comparison of Gold and returns in fixed and equity markets and find a relation

a. Gold as a holding value

b. Spread as a investment value

7. Trading patterns and price fluctuation of Gold Futures in International Market for determining if there is a Gold Bubble.

Secondary

1. Analysis of Various Spread Trading strategies at various exchanges in India and US.

2. Analysis of Data points to see if they are possible for Brent Crude and various other commodities in India

Hedging Brent Crude with Gold Futures

Analysis of Historical Data

To see if there is any correlation and relationship between the price movements of Brent Crude prices and Gold Future Spot prices, the daily prices of both the commodities was collected. The main motive of this exercise is to see if the prices movements of both these commodities have any relationship.

Database Used: Thomson Reuters database for Commodities

Historical Data Range: 3rd April, 1983 to 2nd April 2011.

Correlation between Crude and Gold Futures

The correlation between the Brent Crude and Gold Futures prices show that there is a direct relationship between price movements of both these commodities. However, this value of correlation keeps on changing overtime. This is mainly because of micro and macro economic factors.

The graph below shows the changing values of this correlation factor over time(from 1983 to 2011).

Calculation of Optimal Hedge Ratio

As derived above, the following parameters need to be calculated before and optimal hedging model can be calculated-

1. Change in price of Gold Futures.

2. Change in spot price of Brent Crude.

3. Standard Deviation of price of Gold Futures.

4. Standard Deviation of Brent Crude spot price.

5. Correlation between the SDs of both the commodities.

Net and Gross Profit

The optimal hedge ratio, as per the definition the quantity of hedging instrument needed to minimize the risk for the underlying commodity in consideration. Thus, the amount of Gold Futures needed to be bought/sold for one lot of Brent Crude is same as the optimal hedge ratio calculated.

One key cost involved in the execution of the hedging model is the transaction cost per lot of hedging instrument. This cost is calculated after multiplying the cost per lot and the hedge ratio.

Table below shows the Gross Profit, Transaction Charges and Net profit in this brute force historical price Hedging model.

|

Profits |

No Stop Loss |

|

Gross Net Profit |

$50.37 |

|

Transaction Charges |

$41.42 |

|

Net Profit |

$8.95 |

Table 3: Profits in No Stop Loss

Modifications in calculations of Hedge Ratio (Trend Reversal)

In the process of calculating the hedge ratio using historical prices, the starting date is 3rd April 1983. The correlation between the Crude Oil prices and Gold Futures is not always same. Moreover, it is not always positive or negative. The graph below shows the variation of the historical hedge ratio calculated since April 1983.

Catering to Trend Reversal

One problem that arises when there is trend reversal in the change in prices of both the commodities. Because this model of calculating the hedge ratio uses the historical prices from the early 1983, it makes the model insensitive to the reversal in trends.

The drawback of this insensitivity is that there losses in the hedging model when there should have been profits. Consider a situation where in the hedge ratio till week T is 0.15. The very next week there is recession in the market and there is a trend reversal in the prices of Gold Futures and Brent Crude.

Moving Window Hedge Ratio

The solution for this problem is to use the concept of moving window hedge ratios. I have proposed two moving windows for solving this problem which are-

1. 16 week moving window

2. 3 week moving window

In this moving window, we would be using just last 16 weeks/3 weeks values of the prices, change in prices and respective correlation in the prices in the commodities. This makes the model more robust and sensitive to sudden changes in the economy.

Improvements in Gross and Net profits:

There is a striking difference between the two strategies. Below we can see the values of Gross Profits, Transaction Charges and finally the Net Profit from these two strategies.

|

Profits |

16 Week Hedge Ratio |

3 Week Hedge Ratio |

|

Gross Net Profit |

$49.03 |

$49.56 |

|

Transaction Charges |

$40.85 |

$41.31 |

|

Net Profit |

$8.18 |

$8.26 |

Table 4: Profits from 16 week and 3 week Hedge model

Sensitivity Analysis

On doing the sensitivity analysis of the hedging model, 16 week hedge ratio model of finding the hedging ratio was found out to be the best one. It was financially more viable than No stop loss and 2 week ratio. The table below shows the sensitivity analysis of the difference between the Brute force model and 16 week ratio model.

Stop Loss Model to incorporate the Losses in last weeks

While analyzing the net profits from the hedging transactions, it was noticed that there are some weeks where the strategy gave losses for more some straight weeks. This is primarily because there are some weeks were there is trend reversal in the correlation between the prices of Crude and Gold futures. This can be due to various micro and macro economic reasons.

Three week stop loss

In this model, we are assuming that if there are losses from the model in last three weeks, it would be a loss in the next week also and trade should not be executed. This is because, if there are losses in last 3 weeks, it in turn means that the model has failed to measure the trend reversal which has taken place and future transactions based on calculations form this model should be stopped.

Two week stop loss

In this model, we are assuming that if there are losses from the model in last two weeks, it would be a loss in the next week also and trade should not be executed. This is because, if there are losses in last two weeks, it in turn means that the model has failed to measure the trend reversal which has taken place and future transactions based on calculations form this model should be stopped.

One week stop loss

In this model, we are assuming that if there are losses from the model last weeks, it would be a loss in the next week also and trade should not be executed. This is because, if there is loss in last week, it in turn means that the model has failed to measure the trend reversal which has taken place and future transactions based on calculations form this model should be stopped.

Comparison of all the strategies

Three week stop loss strategy is clearly the winner here. The Gross profit is maximum and therefore the Net profit is also maximum in this strategy.

Figure 6: Comparison of all the strategies

Spread Trading

Spread Strategies used for analysis of Gold Futures

Butterfly spread

An option strategy combining a bull and bear spread. It uses three strike prices. The lower two strike prices are used in the bull spread, and the higher strike price in the bear spread. Both puts and calls can be used. This strategy has limited risk and limited profit.

Butterfly Spread for Gold Futures

A butterfly is a limited risk, non-directional strategy that is designed to have a large probability of earning a small limited profit when the future volatility of the underlying is expected to be different from the implied volatility.

Calculation of Butterfly spread

The time frame for calculation of the spread is taken to be from 4th January 2010 till 20th December 2010. The time frame is such chosen so as the give accurate information regarding the current trends and patterns in the Gold futures prices and respective spreads.

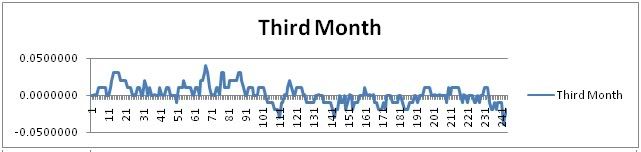

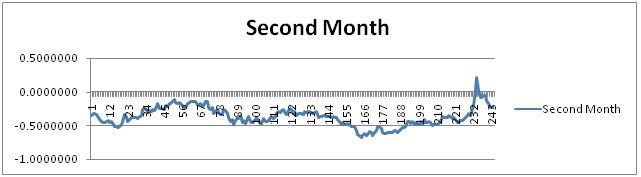

To calculate the butterfly spread of Gold futures, three prices of current, near and far month are used. As we have data for five currently running contracts at NYMEX, three butterfly spreads can be made. There are called as First Month Butterfly, Second Month Butterfly and Third Month Butterfly.

Properties of Butterfly Spread

The following graphs show the variation of the values of the spreads on different dates.

Figure 8: First, Second and Third Month Butterfly spread

There are striking properties which can be extracted from the graphs. These help the traders in making the buy or sell decisions in these strategies and make profits

1. Property of mean reversion: Mean reversion is a tendency for the spread to remain near, or tend to return over time to a long-run average value. A theory suggesting that butterfly spread eventually moves back towards the mean or average. This mean or average can be the historical average of the spread.

2. Range bound values: The range in which the spread varies is range bound. This means that the range of values in which the spread can vary is limited to a particular set of values. By finding major support and resistance levels with technical analysis, a trend trader can buy spreads at the lower level of support (bottom of the channel) and sells them near resistance (top of the channel). The trader may repeat the process of buying at support and selling at resistance many times until the spread breaks out of the channel. The upper boundary of the channel is shown by a trendline that connects the points representing a spread’s highs over a given time period. The lower boundary of the channel is identified by connecting the points representing a spread’s lows. The downside of this strategy is that when a spread breaks out of the channel, it usually experiences a large price movement in the direction of the breakout. If the breakout direction is not favorable for the trader’s position, he or she could lose badly.

3. Trending spreads: This property of spreads helps when there is not much change in the values of futures and they are flat. Even when the future prices are flat, the spreads are not. This gives an opportunity to the trader to take positions easily and book profits.

4. Less Risk: As the values of spreads are range bound, there is very less risk involved in trading spreads. This range bound values makes a cap at the losses that the trader can have.

Iron Condor spread

An advanced options strategy that involves buying and holding four different options with different strike prices. The iron condor is constructed by holding a long and short position in two different strangles strategies. A strangle is created by buying or selling a call option and a put option with different strike prices, but the same expiration date. The potential for profit or loss is limited in this strategy because an offsetting strangle is positioned around the two options that make up the strangle at the middle strike prices.

This strategy is mainly used when a trader has a neutral outlook on the movement of the underlying security from which the options are derived. An iron condor is very similar in structure to an iron butterfly, but the two options located in the center of the pattern do not have the same strike prices. Having a strangle at the two middle strike prices widens the area for profit, but also lowers the profit potential.

Figure 9: First and Second month Iron Condor spread

Comparison of types of condor and butterfly:

The five parameters on which different spread trading strategies can be evaluated are debit/credit, Max Profit, Max Loss, Cost of Position and Profitable range.

It can be seen that the profit from Butterfly spread is always higher than condor spreads. Moreover, Iron butterfly is more probable of giving more profits than normal butterfly. In the same manner, the losses are capped in butterfly trading strategies and they are highest in condor strategy.

The following table gives a comparative study of the strategies with respect to various parameters.

| Condor Spread | Iron Condor Spread | Butterfly Spread | Iron Butterfly Spread | |

| Debit/Credit | Debit | Credit | Debit | Credit |

| Max Profit | Low | High | Higher | Highest |

| Max Loss | Highest | Higher | High | Low |

| Cost of Position | High | NIL | Low | NIL |

| Profitable Range | Wide | Widest | Narrow | Wider |

Table 11: Comparative study of various spread trading strategies

Aayush Jain

Masters of Business Administration (2010-2012)

IIT Kanpur

September 23rd, 2011 at 4:04 pm

It was a awe-inspiring post and it has a significant meaning and thanks for sharing the information.Would love to read your next post too……

Thanks

Regards:

Commodity Market

September 29th, 2011 at 6:53 pm

Not all the time no one can win the match of stock market trade , humans are bounded with emotions and personal affairs that makes them to take wrong decisions at right time even though they are masters of trade. Markets dramatically change they their flow and no one exactly produce or expect 100% from their profits . Choosing the right indicator or analyzing software blended with human aspect gives better results.

regards:

nifty tips

September 30th, 2011 at 3:29 pm

I really appreciate your post and you explain each and every point very well.Thanks for sharing this information.And I’ll love to read your next post too.

Regards

Mcx Tips